Don't Let Natural Disasters Sink Your Savings

Overview

As extreme weather events become more prevalent with each passing year, it’s worth examining the damage they can bring. In addition to the devastating effects storms have on an area’s people and property, they canalso take a toll on your investments.

The National Oceanic and Atmospheric Administration said six major weather events have surpassed the $1 billion mark in losses so far this year, and that was before the most recent threat, Hurricane Dorian, hit the East Coast. The total from last year’s U.S. disasters exceeded $14 billion.

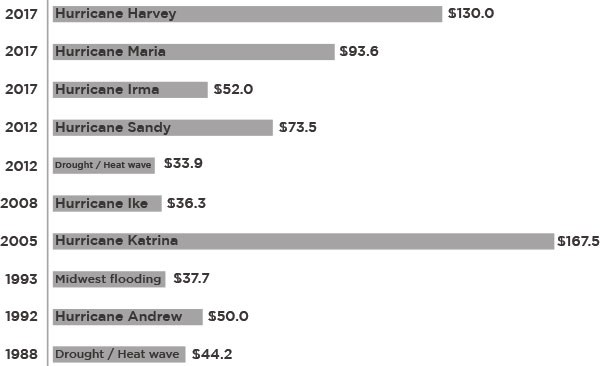

While it’s easy to assume natural disasters have always been around, note in the accompanying bar chart that half of the top 10 most costly disasters in the past four decades happened since 2012 — and are occurring more frequently with each passing year.

Top 10 Most Expensive Weather Events in the U.S. Since 1980

Figures in billions, adjusted for inflation

If you’re a small business owner, the impact of storm damage may be significant. Repairs and business disruption can impact cash flow needs for you and your employees. For large companies, shutting down for a significant amount of time can also impact customers. A shortage of goods frequently means costs are passed on to consumers via higher prices.

Shareholders may be affected by a severe dip in revenues. The ripple effect in any business tends to start close to home and then spread outward, increasing with the time it takes to recover.

When Hurricane Harvey washed ashore in 2017, many oil refineries in Texas had to shutter for a time, which impacted production levels. A similar scenario ensued after Hurricane Katrina made landfall on the Gulf Coast in 2005, causing higher gas prices that not only affected customers but also narrowed profit margins for companies that rely on the transportation of consumer goods.

Natural disasters tend to exacerbate the inherent principles of supply and demand, whereas reduced supplies of consumer staples cause price inflation and become commoditized as a result.

Historical Perspective

The good news is natural disasters, like many other types of temporary market disruptions, don’t tend to have a long-term impact on stock market performance. Three of the most damaging storms in U.S. history — Maria, Irma and Harvey — which all made landfall in 2017, barely registered a blip on the S&P Index. According to one market analyst, there is little evidence correlating storm damage with long-term stock market performance.

“Historically, there is almost no reliable statistical relationship between storm damage and the major indexes.

Tactical Allocations

Some industries are clearly more affected by natural disasters than others, including gas production, home improvement products and services, and property insurance. Because many weather events can be tracked a couple of weeks out, stock price changes and trading acceleration may begin prior to any major weather activity.

On average, gas prices tend to jump about 11%, home improvement and building materials stocks experience short-term “storm gains” of around 7%, and (property) insurance company stock prices tend to decline by about 5%. Note, however, these are generally short-term price changes due to proactive investors looking to take advantage of a temporary surge or protect their portfolio from losses. Price hikes tend to normalize a week or so after a storm has passed, even though the damage and recovery period may continue for weeks or months.

Growth Opportunity

Investors looking to take advantage of the vagaries of extreme weather could consider allocating a portion of their portfolio to renewable energy securities. According to the Department of Energy’s National Renewable Energy Laboratory, not only does renewable energy already produce nearly 20% of the country’s electricity, but the industry has the capacity to provide for 100% of the U.S.’s energy needs via wind and solar. The solar industry alone is capable of producing two times our current electricity needs.

One of the huge advancements in renewable energy is the ability to stockpile surplus power via battery storage. Even at the consumer level, homeowners who have deployed solar roofing panels can “bank” excess energy production for when they lose power. Installation prices also dropped by 76% between 2012 and 2018.

At the investor level, the renewable energy industry now employs more than three times the number of workers in coal, nuclear and natural gas jobs combined. The potential for retraining in the energy field transfers well, catapulting solar panel installation and wind turbine service technicians to two of the fastest-growing jobs in the country.

Diversification

One way to protect your portfolio from the hazards of any vulnerable asset class or industry is to diversify across a wide range of securities. You can do so through broad-based or industry-specific mutual funds and/or exchange traded funds (ETFs). Risk of loss is mitigated by spreading assets across a large number of companies and industries. When one asset category declines, it’s likely there are others to offset losses by outperforming. International diversification across different hemispheres can also help a portfolio weather climate extremes. The Northern and Southern hemispheres experience opposite seasons and, therefore, are not subject to the same types of weather disasters at the same time.

Insurance

One of the best ways to protect your investments is to avoid tapping into them to pay for emergency expenses or property damage. Since the industries that experience stock price and revenue dips during a natural disaster tend to recover quickly, you don’t want to have to liquidate your portfolio to cover household expenses or any loss of income

That’s why it’s important, now more than ever, to be appropriately insured. This includes not only homeowners and, in certain areas, flood insurance but also supplemental insurance for accidents or long-term disability.

Final Thoughts

One of the best ways to protect your investment from the impact of the increasing number of natural disasters each year is the same as the advice your local weather team offers: Be prepared. Expect them to happen, and consider adding components of natural disaster resilience to your portfolio.

You can do so through standard defensive tactics, such as diversifying your asset allocation. You also can add a component of growth opportunity by investing in developing industries that are working toward long-term solutions to offset the impact of extreme weather.

If you do suffer portfolio losses, you may be able to offset them with tax deductions for property damages caused by a natural disaster. Check out the IRS’s website (https://www.irs.gov/newsroom/tax-relief-in-disaster-situations) to see if you meet the criteria for tax relief.