Emotional Investing and Consequences of Behavioral Biases

Distraction from the media, uncertainty or volatility in the markets, or pressure to buy and sell from friends, colleagues, financial “gurus” and other less than reliable sources for investment advice can directly challenge an investor’s ability to make consistent, rational and logical investment decisions. The barrage of information coupled with some inherent behavioral biases can make long-term investing a challenge for most people.

Behavioral Finance has been an academic area of study since the early 2000s when Daniel Kahneman, a psychology professor at Princeton University published research that demonstrated “repeated patterns of irrationality, inconsistency, and incompetence in the ways human beings arrive at decisions and choices when faced with uncertainty.”[i] Dr. Kahneman’s findings won him the Nobel Prize in economics in 2002 and the research strongly suggests that investors will often make decisions based on their emotions rather than on logic and historical data, even if it is right in front of them.

Here we will outline some of the most common behavioral biases so that you, as an investor, can consider whether you can relate to some of them. If you can identify with these biases you may be able to do something about not letting them cloud your vision.

Home Bias

Most of us root for local teams prefer our local coffee shop to the one a few towns over and we are certain that our mom’s apple pie it the best in the world. When making investment decisions, people tend to give preferential treatment to the equities in their home country.

Home bias is problematic for a few reasons. One, there is an entire world of opportunity out there beyond US company stocks that investors should take advantage of. And two, investing in just one region means that you are not well diversified. Investing across industries is only one component of diversification. Geographic diversification is highly recommended for both protection and opportunity.

Loss Aversion

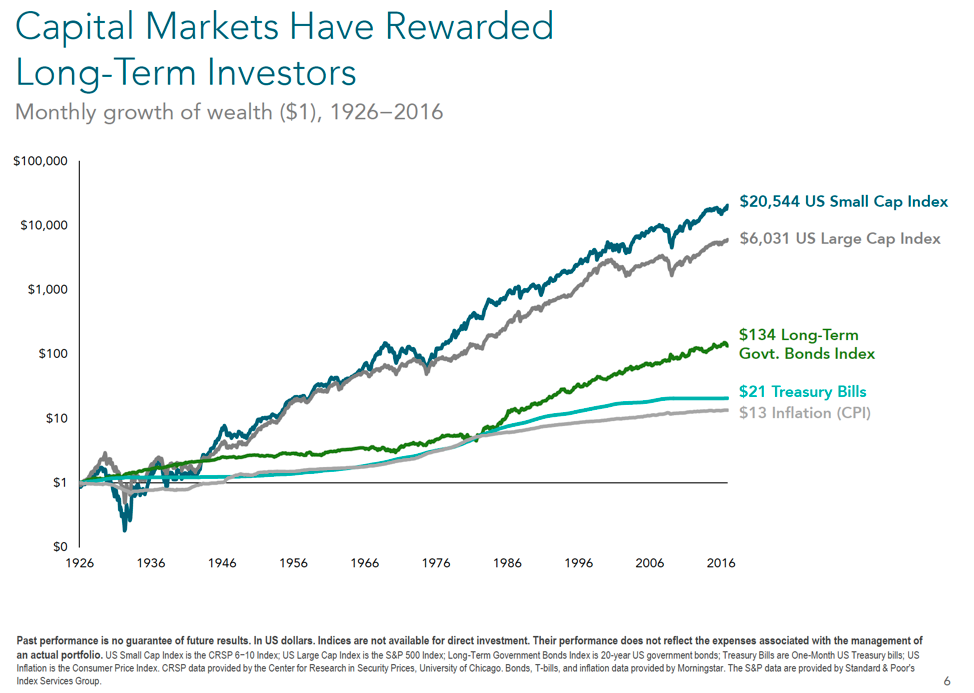

Put simply, we dislike losing a whole lot more than we like winning. In an investing setting, this can lead you to make choices that are too timid to satisfy the goals you have set out to achieve. An unreasonable aversion to risk coupled with unjustified optimism causes many investors to make grand forecasts but timid choices. From a long-term investment, stand-point loss aversion bias is troubling. Investors need to assume a certain level of risk in order to grow their portfolio to meet their needs after they retire and for those who lack the tolerance to assume enough risk, the rate of their portfolio’s growth may not outpace inflation, let alone fund 20 or thirty years of retirement.

Optimism Bias

Optimism bias, in short, is overconfidence. Case in point, we all think we are better drivers than we actually are. A poll asked drivers what they thought of themselves behind the wheel and 80% of drivers said that their driving skills are above average. Anyone driving on the highway would likely not agree with this statement.

When it comes to investing, a great many investors believe they make better investment decisions than they actually do. Optimism bias can also lead us to be more hopeful about investments than we should be. According to a State Street Center for Applied Research study conducted in 2012, investors don’t act in their best interests as they become aware of economic instability and misaligned interests amongst investment providers, government, and markets.[ii]

Recency Bias

As we move through the world we rely on habits to create structure and order in our lives. One could say that we have a habit of forming habits. This is recency bias. When it comes to day to day life habits recency bias works great for a lot of things. When it comes to investing, this type of behavior can trick us into making decisions we may not have made otherwise.

We are hard-wired to use our recent experiences as a benchmark for what might happen next. When the market goes down investors fear that it will continue to do so, and they sell off. If they simply looked at the market chart below they would see that the likelihood of the market continuing to fall and never climbing back up again is, historically speaking, infinitesimally low. But pesky recency bias has our brains thinking only of yesterday and not 10 or 20 years back.[iii]

Confirmation Bias

The scientific method recommends carefully gathering facts, evaluating them and then coming to a conclusion based on your findings. We like to think that we all follow this method in our decision-making process but, the truth is, we don’t. People, by nature, tend to reach a conclusion first and then seek out information that supports the conclusion they already have.

We develop narratives to support our unique concept of reality and, when a conclusion already fits into the narrative we’ve created, it’s comforting. When it comes to investing, confirmation bias can lead you to make portfolio decisions that support your existing investment philosophy or preference for a particular stock by seeking information that serves to perpetuate your beliefs rather than reviewing all of the information available which may or may not discredit your conclusion.

Stay Focused on Your Goals

Hindsight is, as they say, twenty-twenty. Recognizing behavioral biases before they negatively impact your investment decisions will serve you and your portfolio well. Working with a fiduciary financial advisor to help you define goals and manage your portfolio is one of the safest ways to manage your behavioral biases. With both personality and money profiling as part of a holistic financial planning program, a financial advisor should work to help each client to better understand the behaviors that can harm investment performance.

Citations and Sources

[i] Peter L. Bernstein, Against the Gods: The Remarkable Story of Risk (Hoboken, NJ: Wiley, 1998)

Nathan Novemsky, Daniel Kahneman (2005) The Boundaries of Loss Aversion. Journal of Marketing Research: May 2005, Vol. 42, No. 2, pp. 119-128.

[ii] https://www.businesswire.com/news/home/20121112005601/en/Investors-Acting-Interest

[iii] https://us.dimensional.com/

https://www.forbes.com/sites/peterlazaroff/2016/09/28/confirmation-bias/#3416a1654b7d

http://www.investinganswers.com/financial-dictionary/investing/home-bias-6206